YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

Business plans are invaluable to set the course for your company and help you navigate changes – while staying focused on end objectives. Although, I doubt many of us had “Pandemic Contingency Plan” on our radar.

The last global pandemic was more than 100 years ago under very different economic conditions. In general, we were a more agrarian nation with fewer goods and services and less reliance on imports for manufacturing components and consumer goods. None of us running businesses today were even alive then. However, many of us weathered the last recession. We have lessons we can glean from that experience as business owners. And hopefully with the longest economic recovery in history, we are on solid financial footings. I am, however, concerned about the budding entrepreneur who is delaying or shelving their new business launch.

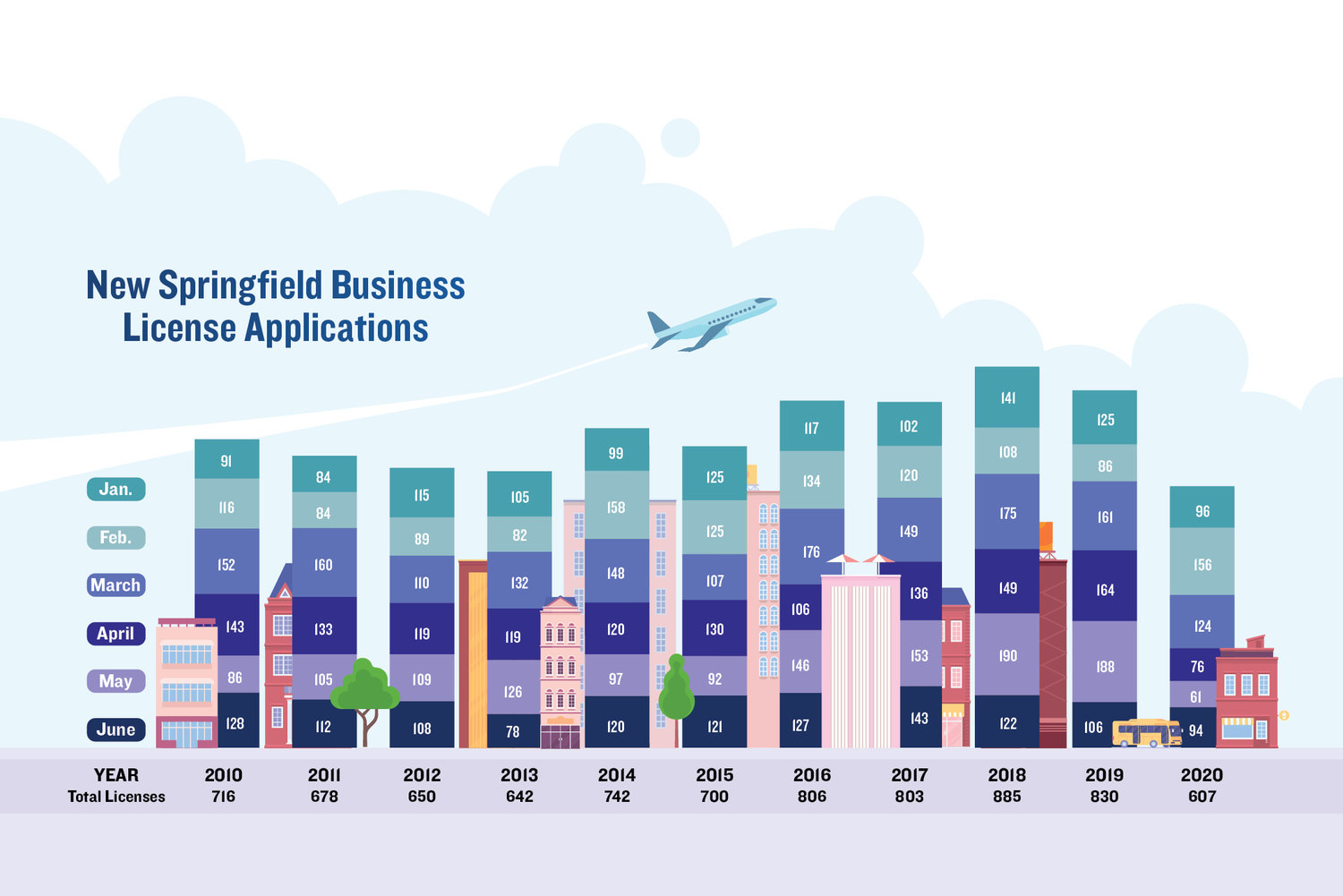

In April and May of 2020, Springfield had fewer business license applications than any two months in the first and second quarters going back 10 years. Year to date ending in June, business licenses are down 27% as compared with the same period last year. So, in addition to established business closures we are falling behind on business starts.

Now is nevertheless a great time for the entrepreneur to take calculated risks with potentially big rewards. Here are a few tips:

• Rather than starting from scratch, look for a business similar to your startup idea. Or maybe you’re just seeking an opportunity to invest. Many owners are looking to step away not because the business is in bad condition but because they have no desire to navigate the current climate. Some great businesses will become available in this time period.

• If you are entertaining purchasing a business that took a Paycheck Protection Program loan, be sure you understand the implications for you. The rules are different than a typical business purchase and may have long-term implications for you.

• Even if you don’t buy the business, look for opportunities for used furniture, fixtures and equipment. You can save an extraordinary amount of money if you’re willing to forego new items.

• Establish your team of trusted advisers: accountant, attorney, banker and insurance professional. They will be able to bring their unique expertise to represent you, whether you are buying or starting a company. A little money invested in good advice can save you from making potentially devastating decisions.

• Check out the great lending opportunities available through the U.S. Small Business Administration. Right now, they are making loans more attractive and working as many aspects as possible to keep America’s small-business community thriving. Be sure to select a bank with SBA-preferred lender status. You know that they are experienced in navigating the system and are able to process loans much quicker.

• Tap into the resources available through the Small Business Development Center at Missouri State University. They offer a wealth of services and training for business owners.

• Don’t be afraid to negotiate the terms of your retail, restaurant or office space. Owners of commercial space like myself are ready and willing to help you get started on the right foot.

While this might be a scary time to start or buy a business, if you are committed to savvy planning and adapting you will fare well.

Missouri State University’s science building, built in 1971 and formerly called Temple Hall, is being reconstructed and updated.