YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

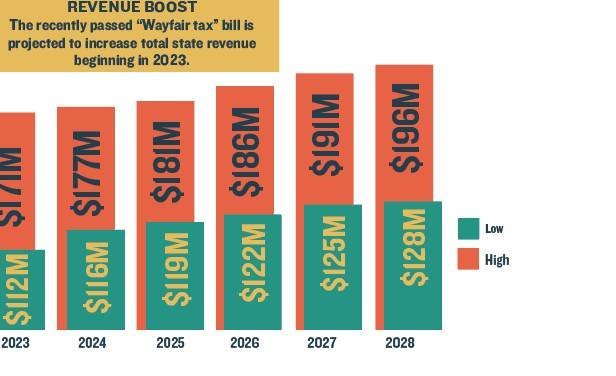

Gov. Mike Parson yesterday signed the "Wayfair tax" bill into law, creating an online use tax.

Named after the 2018 U.S. Supreme Court case South Dakota v. Wayfair Inc. that ruled in favor of the tax, the levy applies a city or state’s sales tax rate to online purchases from vendors that are not located in that state. The bill passed the General Assembly on the final day of the 2021 Missouri legislative session, according to past reporting.

"This law will help even the playing field between Missouri small businesses and large out-of-state retailers," Parson said in a news release. "With more than 570,000 small businesses in the state of Missouri, it is time that we establish a 21st century tax code that benefits our Main Street businesses rather than companies that don't invest in our communities or employ our citizens."

The tax impacts online retailers that sell more than $100,000 in tangible goods annually to consumers in Missouri. Collection begins Jan. 1, 2023.

Missouri is the final state in the nation to adopt an online sales tax, according to the release.

Utah-based gourmet cookie chain Crumbl Cookies opened its first Springfield shop; interior design business Branson Upstaging LLC relocated; and Lauren Ashley Dance Center LLC added a second location.

Updated: Systematic Savings Bank to be acquired in $14M deal

Warby Parker store planned in Springfield

Former CoxHealth colleagues starting communications firm

Former Wentzville superintendent to get $1M in contract buyout

STL construction firm buys KC company

NPR editor resigns after writing piece critical of organization

Survey finds increase in average salary Americans willing to take

It impacts the consumer, who will take the hit for this. We needed more taxes added to the things we need to buy.