YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

Is the Springfield market really overbanked?

Anecdotally, the answer is yes. Talk to bankers, financial professionals and even the general public, and it seems the recurring sentiment is that it’s a hypercompetitive market. Follow the conversation to its end, and you’d believe we have more financial institutions than we know what to do with.

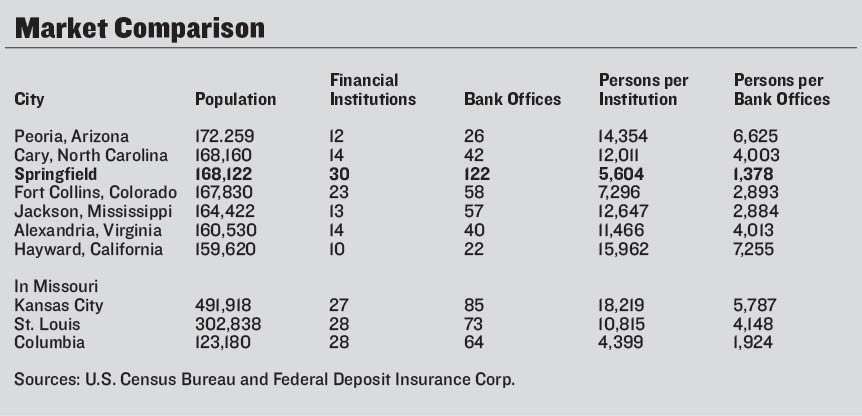

Here’s the statistical backdrop: The population in the city of Springfield is 168,122, according to the U.S. Census Bureau estimate for 2018, the most recent data available. There are 30 financial institutions doing business within city limits, according to the Federal Deposit Insurance Corp.’s deposit market share report, as of June 30. Additionally, those institutions operate 122 offices in Springfield.

Do the math and we have one financial institution for every 5,604 people living in the city – and one bank office, or branch, for every 1,378 city residents.

So, I want to know how that compares with other markets. We may feel overbanked, based on these numbers or on the quantity of bank offices and signs we see around town.

To answer that, I’ll compare the numbers with cities of similar size around the country. But first, let’s see how Springfield compares in the Show-Me State.

Kansas City has a 2018 population estimate of 491,918, and St. Louis has 302,838 people. At first glance, both those totals seem small, but remember we’re talking city proper populations – not metropolitan areas – and strictly on the Missouri sides. Follow me to the FDIC market share reports within those city boundaries, and we see 27 institutions comprising 85 bank offices in Kansas City. On the other side of the state, St. Louis has 28 institutions and 73 bank offices. That’s one institution for every 18,219 people in Kansas City and one for every 10,815 people in the city of St. Louis.

Meanwhile Columbia, population 123,180, has one institution for every 4,399 people and one bank office for every 1,924 residents.

Conclusion: Springfield is overbanked compared with Missouri’s larger cities but not so much with its peer in the middle of the state.

Next, I’ll look at U.S. cities of comparable size.

Two most similar are Cary, North Carolina, and Fort Collins, Colorado – both at right around 168,000 people. On the East Coast, Cary has less than half the number of banks and a third of the bank offices compared with Springfield. Out west, Fort Collins is closer, but it’s per capita numbers – nearly 7,300 institutions and 2,900 branches per resident – are less banked than Springfield.

I crunched the FDIC and population numbers on a half-dozen peer cities – two slightly larger and four a bit smaller than Springfield – and none comes close to the number of banks or branches doing business in our city. Fort Collins is the closest.

Of course, this doesn’t factor in city size in comparison to the rest of the state (Springfield being the third-largest in Missouri and thus a significant economic player, whereas the others compared may not be as critical on a statewide level).

The numbers don’t lie. Surprisingly, Columbia emerged as more overbanked than Springfield. But now we know our city is the queen of banks.

Springfield Business Journal Editorial Director Eric Olson can be reached at eolson@sbj.net.

Alair Springfield is first Missouri franchise for Canada-based company.