YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

The reality for employers amid the coronavirus pandemic is that business operations and government ordinances are changing daily.

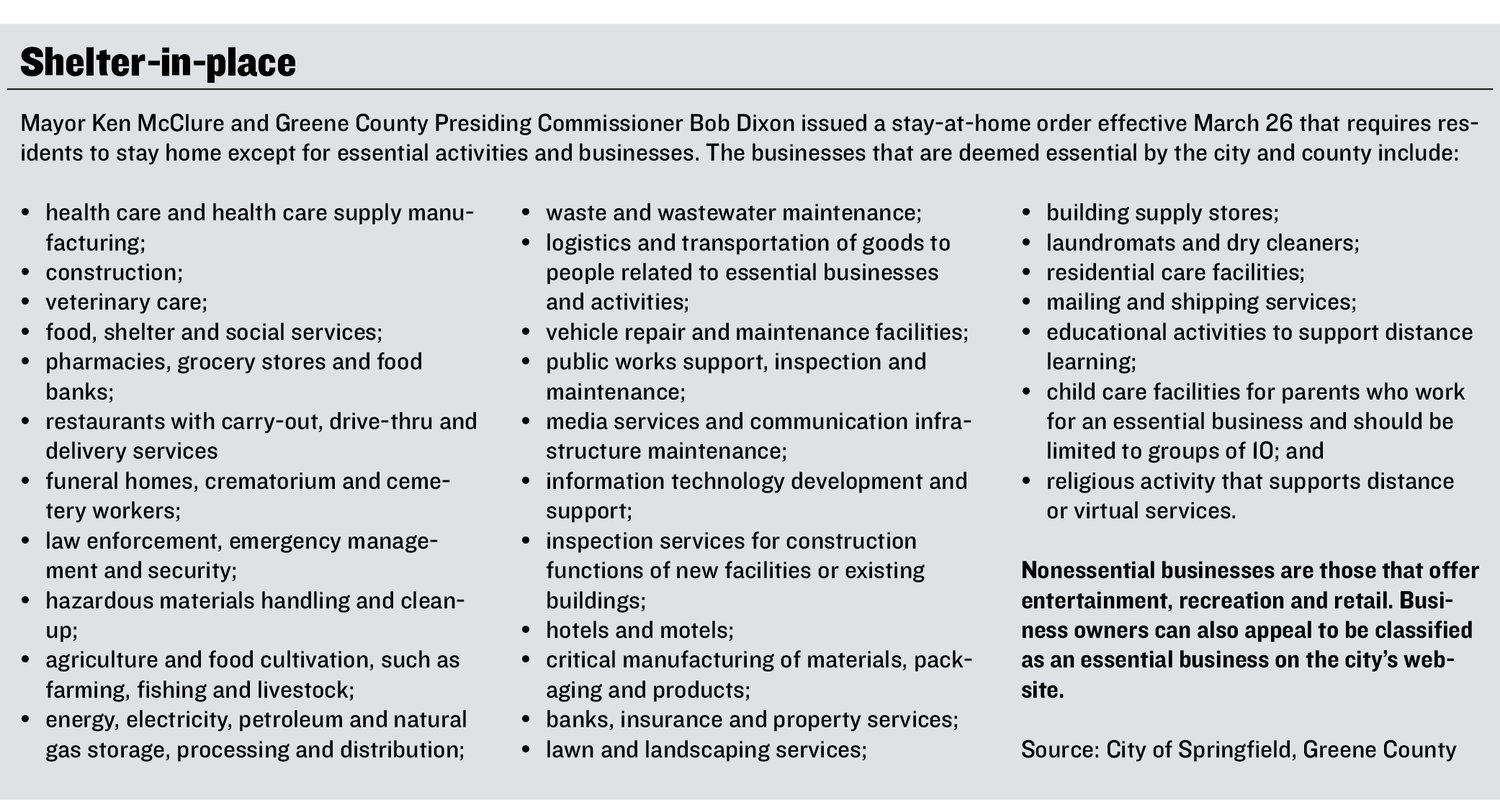

As of March 26, some businesses were ordered by the city and county government to cease operations altogether as part of a stay-at-home ordinance. Essential businesses, such as health care facilities, grocery stores and banks, are allowed to stay open with some restrictions.

Many business owners are having to adapt to continue making sales and payroll, and some are looking to federal loans to stay afloat.

The U.S. Senate also passed a stimulus package on March 25 that will inject the U.S. economy with about $2 trillion in aid – the largest rescue package in American history, according to media reports. The package, which awaits approval from the House of Representatives, includes billions in aid to large and small businesses, direct payments to Americans, expansion of unemployment insurance and $150 billion to shore up the health care industry.

On the state level, the Missouri General Assembly has approved a $40 million allocation to the health care industry for personal protective equipment and additional testing.

Business models

At Bawi Korean BBJ and Hinode Japanese Steakhouse in Springfield and Nixa, owners transitioned their restaurants to a carry-out service alongside city government recommendations, followed by discounts on most meals that ranged from 40%-60%.

The restaurant owners went a step further in mid-March, saying they wouldn’t be taking a salary or profit sharing for the time being, and managers agreed to accept minimum wage compensation.

“Our sole focus is keeping people employed and providing affordable food,” said Rosal Tapp, human resources director for the restaurants. “All of this is just for the staff. The way you treat your people in this circumstance is really going to change the way they feel about coming back.”

So far, Tapp and restaurant co-owner Cosmo Kwon said they have been blown away by the community support. While the number of orders has dipped below what they would normally sell during the week, Kwon said the number of weekend orders are seeing no change. He declined to disclose sales but noted they are well below the company’s average due to the menu discounts.

Kwon said his restaurants, including Bawi Korean BBQ, have prepared over 10,000 orders since the initial announcement on March 20. Amid the hustle, they’ve had to close Springfield’s Hinode for a few days to allow staff to refresh from the busy shifts.

The ownership group is providing free meals to such organizations as Boys & Girls Clubs of Springfield, the Discovery Center of Springfield Inc. and Springfield Public Schools.

“Funds are in limited supply right now for everyone. We want to do what we can,” Kwon said. “We have a lot of food in stock, and we want to donate meals as we’re able to.”

Tapp said the company is offering opportunities for temporary layoffs to staff members who don’t want to work in the restaurant environment amid COVID-19. Those that accept the offer may be eligible for unemployment. She was unaware of any employees taking the offer by press time.

Tapp said the ownership group was considering applying for a business loan through the SBA.

The U.S. Small Business Administration is offering disaster recovery loans to businesses across the United States.

Dubbed economic injury disaster loans, the working capital is available to small businesses with a maximum interest rate of 3.75% for up to 30 years, according to a news release. The loan is limited to $2 million for alleviating economic injury.

Chrystal Irons, director of the Small Business and Development Center at Missouri State University, said the five-person team has been busy assisting business owners with applications for the disaster recovery loan.

“My calendar is packed full every day this week, and I don’t anticipate that will slow down,” Irons said in a March 23 interview.

She’s encouraging business owners to apply for a loan amount they could have supported prior to COVID-19 disruptions, as well as to consider loan deferments and insurance adjustments.

“Most lenders are working with their clients right now on loan deferment, and cash flow is important to try to maintain, too. There’s a lot that they can be doing while they wait for disaster recovery,” she said.

Irons said she was unsure when awarded businesses would begin to receive the loan funding.

Other moves

Prior to the stay-at-home ordinance, businesses such as Hudson Hawk Barber & Shop had announced temporary closures. Hudson Hawk plans to reopen April 24, according to a Facebook post.

Meanwhile, operations aren’t stopping at Paul Mueller Co. The stainless-steel equipment manufacturer announced in a March 24 news release that it was classified by the federal government as a critical manufacturer. Mueller Co. officials say the company is allowing employees to request leave, and if approved, they’ll maintain their health insurance coverage and standing in the company, and they’ll receive assistance via all available sources of pay.

“We believe that we can continue to also meet the needs of our customers, many of whom are on the front lines of caring for our country right now,” Mueller Co. President and CEO David Moore said in the release.

Other companies have had to temporarily lay off employees.

O’Reilly Hospitality Management LLC made an undisclosed number of layoffs in mid-March in response to COVID-19, according to past Springfield Business Journal reporting. CEO Tim O’Reilly pointed to travel restrictions that impact the hospitality industry.

“I’m extremely committed to bringing all these people back,” O’Reilly said. “We are going to survive. We’re going to get through this.”

Shawn Askinosie, founder and CEO of Askinosie Chocolate LLC, on March 24 furloughed half of his factory workers. He plans to bring back those 10 employees in 60-90 days.

“That’s the reality that we find ourselves, in order to maintain financial viability and be a responsible citizen in regard to the stay-in-place order,” Askinosie said. “I’ve spent 15 years building this and ... I have an obligation to the community and to my employees that are furloughed, and not furloughed, for them to have a business to come back to.”

The individuals are eligible for unemployment, he said, pointing to the federal stimulus package that could bring some relief.

Askinosie Chocolate will continue production with three people and another in shipping, Askinosie said, noting the company has more than a year’s supply of cocoa beans to make chocolate.

“We are still receiving significant online orders from people around the country and in small specialty food stores. However, we’ve also seen a dramatic reduction in ingredient chocolate sales,” he said, adding those sales generally are made by restaurants, coffee shops and ice cream manufacturers.

He said the storefront and factory tours have been shut down.

“My primary objective in all of this is to yes, financially get by on what I would say is one engine, and that we’re going to get through that and do what we can for employees and run the business the best way we can,” Askinosie said.

Web Editor Geoff Pickle contributed.

Utah-based gourmet cookie chain Crumbl Cookies opened its first Springfield shop; interior design business Branson Upstaging LLC relocated; and Lauren Ashley Dance Center LLC added a second location.

Updated: Systematic Savings Bank to be acquired in $14M deal

Warby Parker store planned in Springfield

Former CoxHealth colleagues starting communications firm

Former Wentzville superintendent to get $1M in contract buyout

STL construction firm buys KC company

NPR editor resigns after writing piece critical of organization

Survey finds increase in average salary Americans willing to take