YOUR BUSINESS AUTHORITY

Springfield, MO

YOUR BUSINESS AUTHORITY

Springfield, MO

Branson Airport no doubt faces an uphill battle, but the private facility continues to trudge along, with Frontier Airlines soon landing a long-awaited return to the tourist town.

Effective June 13, Frontier Airlines will start offering flights three days a week to and from Denver International Airport. For another needed push, a new fleet of 46-seat turboprop planes from Silver Airways is expected to hit the Branson runways by Aug. 30.

Silver Airways will be making flights from New Orleans, Houston and Chicago, also offering booking agreements with United Airlines, Delta Airlines, Alaska Airlines, Air Canada and other foreign airlines.

The deal triples the number of airlines on board. ViaAir LLC last year joined Branson Airport, running flights to Austin, Texas, while previously the airport relied on charter services.

Branson Airport Executive Director Jeff Bourk declined Springfield Business Journal’s interview requests. But in an email, Bourk highlighted the added flight options.

“We are looking forward to 2018,” he wrote. “We expect traffic will be significantly up at Branson over the last several years.”

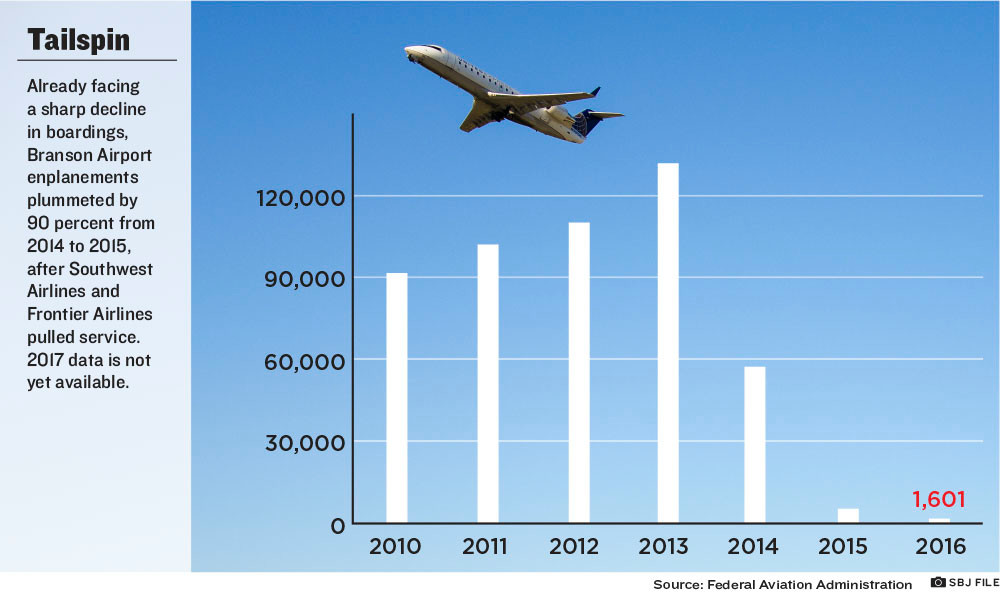

From 2016, the number to beat is a meager 1,601 enplanements, according to Federal Aviation Administration records. 2017 data is not yet publicly available.

Bourk pointed to tourism, such as the area’s burgeoning golf scene, as a key driver to increase air traffic.

“The market growth in new attractions, leading to increased visitation, attractiveness as a convention market and visitor spending, are all factors that have played a significant role in bringing significant air service back to Branson Airport,” Bourk said in an emailed statement.

In Branson, Silver Airways plans to utilize its new fleet of ATR-600 turboprops aircraft for the year-round service, said Branson Airport spokeswoman Rachel Wood. The airline last year agreed to purchase up to 50 ATR planes in a deal valued at as much as $1.1 billion, according to an industry report at ATWOnline.com.

The slip

The 2016 traffic count reflects a drop of nearly 70 percent from 5,147 enplanements in 2015, according to the FAA.

Branson Airport peaked at 131,806 enplanements in 2013 when Dallas-based Southwest Airlines Co. entered the market. That same year, operating income was in the black, a rarity for the privately held airport.

Built for $148 million, it opened in 2009 and recorded more than $14 million in operating losses from calendar years 2010-12, with net losses exceeding $50 million, according to Municipal Securities Rulemaking Board data.

The airport, meanwhile, defaulted in 2011 on nearly $115 million of the bonds secured to build the facility, according to SBJ reporting at the time.

Briefly in the black, the facility brought in about $3.9 million over expenses in 2013, though still posted another nearly $8.5 million in net losses for the year.

Operational losses dipped to the tune of $423,000 in 2014, when Southwest Airlines and Denver-based Frontier Airlines pulled out of the market, according to SBJ archives.

In 2015, the number of passengers boarding Branson Airport flights – technically known as enplanements – dropped by more than 90 percent from some 57,300 enplanements in 2014, according to FAA data.

Through 2015-16, Branson Airport continued to hemorrhage millions of dollars, with net annual losses of $10 million-$11 million, according to the MSRB data.

The FAA’s 2016 enplanement data was made available in October 2017.

Incomplete MSRB data through August 2017 – the last available MSRB monthly financial report – shows a combined eight-month operational loss of roughly $600,000, with net losses of nearly $3.5 million.

MSRB financial reporting from Branson Airport – which is tied to its bond debt – also indicates the facility lacked an approved operating budget during June and July.

As for enplanements, the facility averaged about 816 outgoing passengers per month from March through August, with zero enplanements reported in two of those months, according to the MSRB data.

With roughly 8,100 available seats, the MSRB data indicate Branson Airport was filled only 60 percent through August.

Industry crunch

Springfield-Branson National Airport Aviation Director Brian Weiler said airports generally serve as a barometer of local economies, but there’s also an industry crunch – especially for smaller facilities – from continued flight consolidations and other issues.

In Springfield, the state’s lone FAA small-hub airport has been recording banner years for air service, coming ever closer to its goal of 1 million passengers. Year-to-date enplanements through March, for example, were up 8 percent to more than 109,000, Weiler said.

As for the industry, he noted 85 percent of available domestic airline seats are controlled by the largest airlines: American, Delta, United and Southwest.

Aircraft are only growing in size, and the airline companies want full flights, all the while scrutinizing a local airport’s bottom line, Weiler said. He added that substantial local discounts and subsidies also are sometimes needed to keep the airlines from taking off for good.

Small, nonhub airports – such as Branson Airport, where privatization prohibits federal subsidies that commonly buffer the bottom line for public facilities – are among the hardest hit, Weiler said.

“You look at what’s coming out of Boeing, and Airbus and Embraer, these new planes that are coming out in the market ... are just incredible,” Weiler said.

“But, like, if you’re an ‘XYZ’ Montana or ‘ABC’ up in Kirksville, Missouri, and you can’t fill a 75-seat aircraft,” he added, “a lot of times (airlines) are just going to pull. That’s where the big dilemma is.”